High ROI projects in Dubai

Spacious Studios to 3-Bed Homes from AED 1M to 2M

Discover premium apartments and townhouses from AED 1M–2M in a vibrant new community. Choose from off-plan and ready homes designed for comfort, style, and lasting value.

Why UAE Real Estate Delivers Higher ROI Than Other Global Markets

The UAE real estate market has rapidly gained global recognition, emerging as a powerful investment destination. With tax-free returns, high rental yields, and supportive government policies, the region has built a reliable environment for investors seeking long-term growth and stability.

Here's a breakdown of five compelling reasons why UAE property consistently delivers stronger returns on investment (ROI) than many traditional global markets.

One of the standout advantages of investing in UAE property is the complete absence of personal income tax. In contrast to cities in Europe, the UK, or North America—where rental income is heavily taxed—earnings in Dubai, Abu Dhabi, and other emirates are entirely tax-free.

For example, if your property generates AED 100,000 in annual rent, you keep every dirham. There are no deductions for federal, state, or local taxes. Over time, this significantly boosts net income and enhances compounded returns on your property investment.

While rental yields are important, capital growth is a key contributor to ROI. The UAE real estate market—especially in high-demand areas like Downtown Dubai, Business Bay, Dubai Marina, and Jumeirah Village Circle—has demonstrated steady price appreciation over recent years.

Several factors fuel this growth:

Large-scale infrastructure and smart city projects

International events like Expo 2020

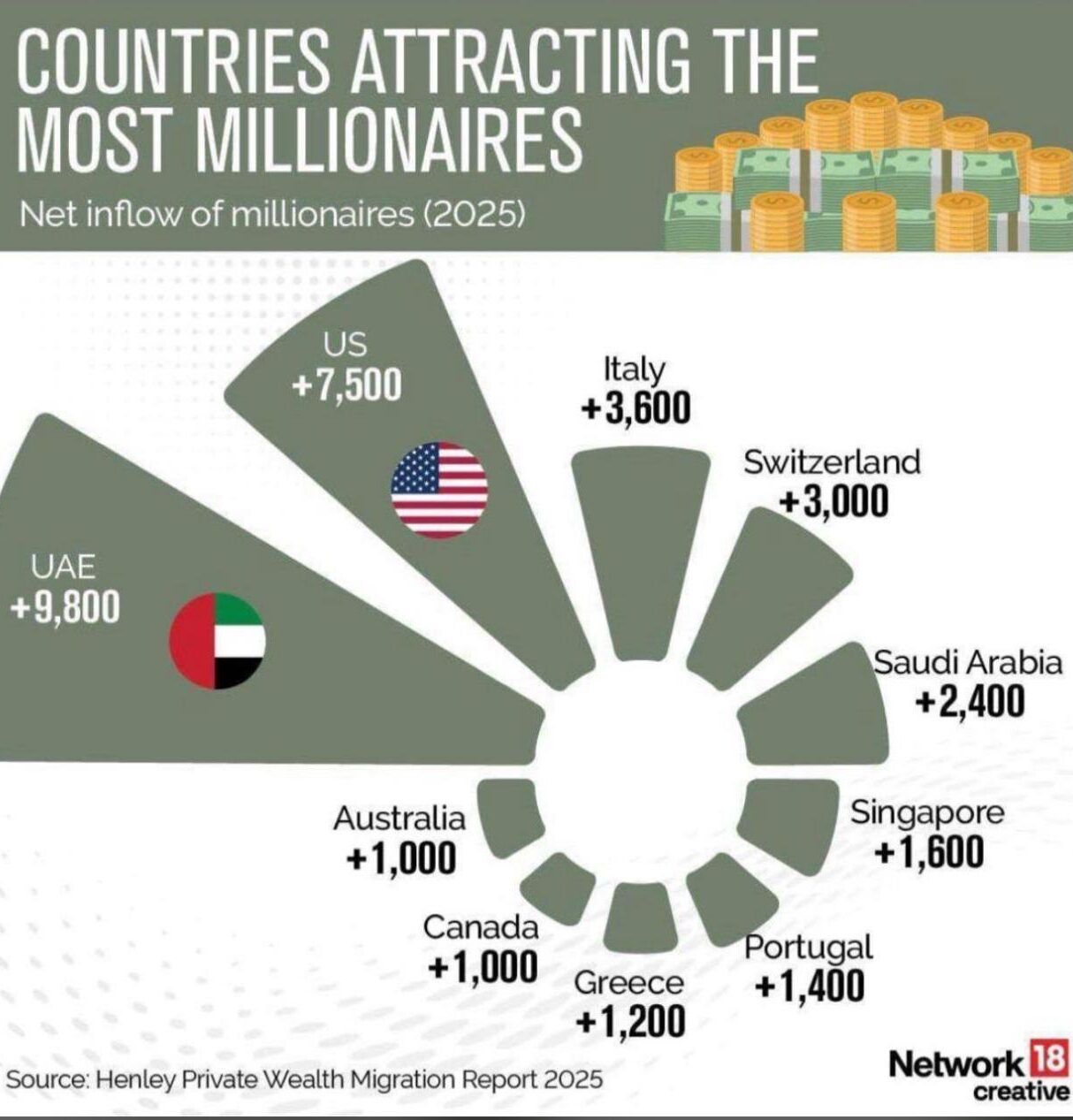

An increasing number of expatriates and investors relocating to the UAE

Compared to mature global markets, where appreciation has stagnated due to interest rate hikes or overdevelopment, the UAE remains in an expansion phase, offering both growth potential and investor-friendly conditions.

The UAE stands out for its open property market policies. Foreign investors are allowed 100% freehold ownership in designated areas, including Emaar Beachfront, Dubai Hills Estate, and Yas Island.

This means:

You hold the title deed outright

You can rent, resell, or pass the property to heirs

No local sponsor or joint ownership is required

In contrast, many other countries enforce ownership restrictions—such as quotas, leasehold limitations, or nationality-based exclusions. The UAE’s clear legal framework and ownership rights give foreign investors confidence and control.

One of the UAE’s biggest competitive advantages is its cost-to-return ratio. Properties in Dubai and Abu Dhabi are significantly more affordable per square foot compared to cities like London, New York, or Singapore—yet rental yields are impressively higher.

Average ROI Comparison:

Dubai: 7.5%

London: 3.2%

New York: 2.8%

Singapore: 2.5%

This combination of affordability and strong rental income allows investors to enter the market with relatively lower capital, while still enjoying meaningful cash flow and long-term equity gains.

UAE developers are known for their investor-first approach. Leading names like Emaar, DAMAC, Sobha, and Aldar offer:

Low down payments starting from 5%

Post-handover payment plans (up to 5 years)

Interest-free installment options

Zero commission offers

Waived DLD registration fees

Fully furnished property options

In contrast, investors in other markets often face complex buying processes, heavy stamp duties, and bureaucratic mortgage hurdles. The UAE streamlines this journey—making it easier for both first-time and seasoned investors to step in with confidence.

Why Dubai for High-Rental Yields?

Dubai’s luxury real estate market thrives due to several key factors:

High Rental Demand: A 3.8M+ population (90% expatriates) and 18.7M tourists in 2024 drive consistent rental demand.

Tax-Free Income: No income or capital gains tax maximizes net returns.

Golden Visa Program: Investments above AED 2M qualify for 5- or 10-year residency, attracting long-term investors.

Tourism and Business Hub: 18.7M visitors and a 3.2% GDP growth in 2024 fuel short-term rental markets.

Regulatory Stability: The Real Estate Regulatory Agency (RERA) ensures transparency, reducing investment risk.

Download Brochure

All you need to know about this project

GALLERY

Live or Invest in Dubai’s Top Communities

- Luxury Apartments Starting at AED 1M

- 7–8% Rental Returns | Ready to Move

- JVC | Al Jaddaf | Al Furjan | Town Square

LOCATION

* By clicking Submit, you agree to

our Terms & Conditions and Privacy Policy

© 2025 All rights reserved.